Mind Crunches #33: The Modern Middle Ages

Winning and losing at the Geopolitical Monopoly game

📝 Essay: The Modern Middle Ages

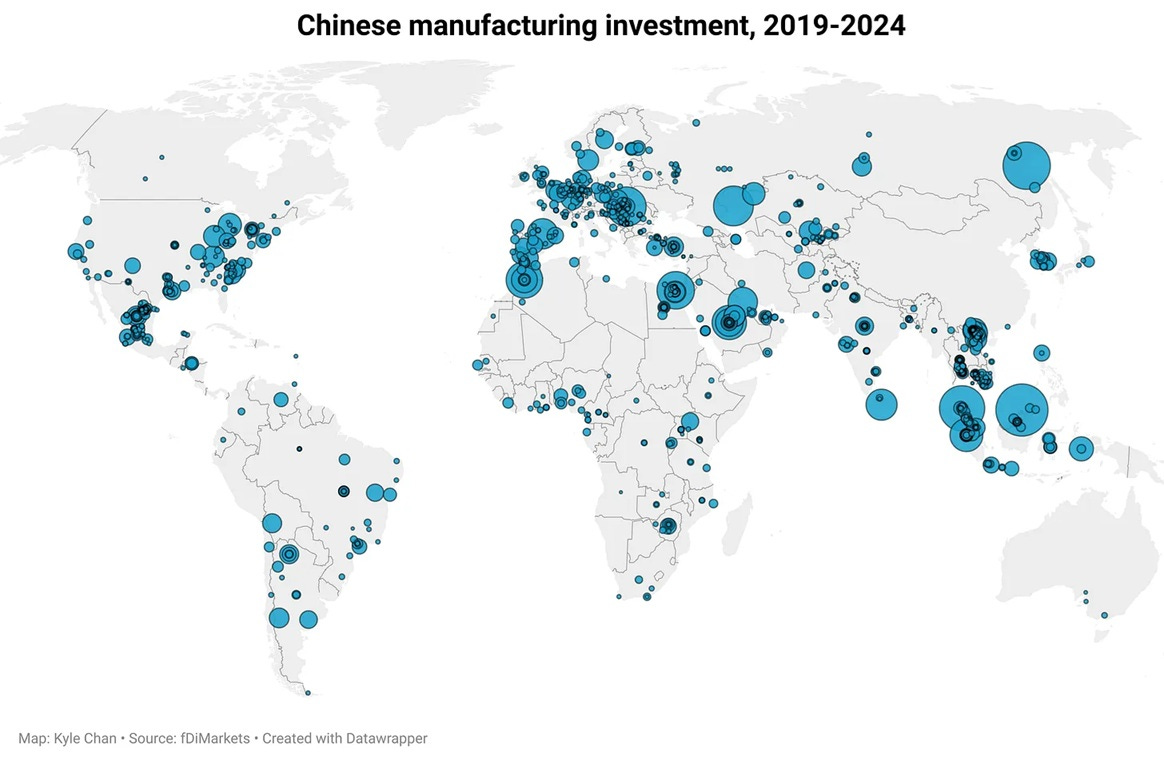

As I have written in previous posts, I believe we are currently seeing the world order, that was established after the end of the Cold War, being reshaped in front of our eyes. I have been reading and thinking a lot about how -seemingly- unrelated factors (from rare earth minerals to stablecoins) converge into a new world order that I personally call Glocalization. You can read the whole article to get a better sense of my theory but if you want the tldr version, Glocalization is characterized by an extremely fragmented world where geopolitics becomes a marketplace. Supply chains, trade agreements, transatlantic organizations and long-standing partnerships (both on corporate and national level) have been fractured (due to Covid, trade & actual wars) and replaced either by top-down forced partnerships governed by a big power (China's industrial diplomacy creating China-friendly global production networks in SEA and Africa to bypass tariffs) or by small, agile and flexible collaborative clusters (US moving all AI critical production to UAE to bypass local NIMBYs and lack of energy abundance).

So where do we go from here? What will be the new playbooks and national agendas? Can we avoid the infamous Thucydides Trap and not end up in a war between the US and China? My developing thesis is that we are entering an era of radical entropy in all levels (from personal to planetary) where there is no Great-Power Competition but a marketplace of geopolitics (resembling a lot the Medieval ages) with China dominating the chessboard unless AGI arrives faster than we think.

Towards Active Players & National Capitalism

Today’s reality is that we live in a truly multipolar, multicivilizational and multiregional system in which no power can dominate over others — while all can freely associate with others according to their own interests. We see the emergence of multi-alignments in which swing states, regional actors and almost every other country actively play all sides in pursuit of their own best deal. The new playbook is Active Positionalism: each country and corporation, large or small, places itself at the center of its own calculations. For example, the greatest player in Active Positionalism at the moment is Sam Altman who has been playing a Geopolitical 4D chess partnering with almost all major Big Tech companies, not being afraid to sue his first major partner Microsoft (note: if you are a loyal reader of this blogpost, you remember that I have been arguing that the MSFT<>OAI deal is not bullet proof) while being in the forefront of the American-led deals in UAE for new datacenters.

The fragmentation we now see in trade will likely extend into finance. States that once relied on global capital markets are increasingly treating capital as a strategic resource. Thus, we are entering an era of “national capitalism”—where governments no longer leave capital allocation to markets but instead channel it toward politically chosen priorities. This is already visible in China focusing on lithography and hard manufacturing capabilities, US on chip manufacturing, Turkey on defense etc

From a first look, this isn’t necessarily bad news because it can empower the West to finally increase its state capacity and resilience which I consider to be the single most important issue in today’s world. But as global institutions that once underpinned free trade weaken, this will further deepen geopolitical tensions and accelerate the decline of the open, rules-based order.

Manufacturing Is Eating The World & China Is Eating Manufacturing

So with that context in mind, China is making a very clear bet. They believe that Manufacturing and Energy are the absolutely most important pillars for state capacity, resilience and long-term dominance.

For most of the past 15 years, many assumed software alone would define the future. Marc Andreessen's 2011 claim that “software is eating the world” became both a policy textbook and a “lifestyle” with thousands of brilliant young people getting obsessed with launching software startups.

But is seems that the world of atoms is still more important than the world of bits. Manufacturing allows far greater productivity gains than services, which depend on human hours. It scales through specialization (which is very hard to pass as tacit knowledge to next generations), learning, economies of scale, and spillovers that lift entire sectors. Services, by contrast, struggle to grow without losing quality. The real frontier lies not in inventing new technologies but in embedding existing ones into the physical world at a scale and precision we've never seen before.

China’s manufacturing capacity is unprecedented. China makes over 60% of the world's electric vehicles, leads in solar and battery production, and advances in semiconductors. Nearly every hardware startup ends up there because no one else matches China's mix of speed, quality, and capacity.

But for manufacturing to succeed you need energy abundance. China consumes nearly 30% of global electricity. Solar costs dropped 90% in a decade. It controls the mineral supply chains that feed these industries. China is becoming what the Financial Times now calls the world's first “electrostate”—an economy where electricity's rising share of total energy use drives fundamental transformation. Energy storage capacity has grown twentyfold in just four years. Meanwhile, China builds nuclear reactors in 5-7 years compared to 15-20 years in the West.

China’s manufacturing capacity also leads to a darker equilibrium. China currently leads, in terms of manufacturing capabilities and sheer numbers of production, each and every component that small, modern drones need. And apparently, drones is right now the single most important deciding factor in modern warfare. Noah Smith’s post is a must read and a punch in the face.

Stablecoins: The Hidden Weapon of the U.S.

So with China being the Golliath of manufacturing and with no major power able to impose itself on the global financial system, what can the U.S. do? The future will look like an unstructured map of small islands of stability connected through networks of capital (more so) and technology (less so).

The obvious answer is to focus on AGI and this is correct but I will analyze it in a future post. At the moment, there is another area where a huge power game takes place: global trade settlement. Most global trade is still denominated in dollars, but new agreements are undercutting Washington’s blocking power. China is the largest trading partner of most countries in the world, and incrementally converting its trade with them into RMB currency, meaning they will increase their RMB share of reserves in order to finance imports.

But stablecoins -programmable digital assets- may offer the foundation for a new kind of cross-border financial system. Unlike traditional banking systems, which move money through correspondent banks with delays and hidden fees, stablecoins operate continuously, settle transactions within seconds, and can be programmed to carry out automatic actions. From this perspective, the US seems to be doubling down to stablecoins as a strategic national bet with the Senate recently passing the GENIUS Act. Most stablecoins in circulation—especially the largest ones, like USDT (issued by Tether) and USDC (issued by Circle)—are pegged to the US dollar and backed by reserves held in US Treasury bills. When someone around the world buys a dollar stablecoin, they indirectly help finance the US government.

What’s next?

On a planetary level, I personally can’t see how we will continue living in a US-centric world order unless Open AI (or a coalition of American AI startups) introduces AGI first and puts it into use for better, faster, smarter state capacity (from defense tech to productivity optimization) in the so called West. This, along with a successful digital dollarization of the new global commerce, is the only potentially alternate future than the currently obvious path of an archipelago of small sovereign states, corporations and communities connected only by a China-led supply chain system. Every economic indicator shows something simple: China mirrors America at exactly the same moment—around 1870—when the United States was building the industrial foundation that would define the next century.

On a more micro scale, global entropy doesn’t necessarily mean anarchy. To the contrary, the system exhibits characteristics of self-organization, even aggregation, into new patterns and formations. The Internet (for the past 20 years) and Crypto (the next 20 years) transcends borders to link self-governing social communities the same way railways and airlines did it the past 100 years. The universal reach and penetration of connectivity and the trustless nature of blockchains will enable authorities of all kinds to forge bonds effectively more real than the many states that exist more on maps than in their peoples’ reality. Balaji’s Network State has its flaws but it’s an undeniably fascinating experiment. The most successful will likely see today's fragmentation not as a temporary disruption but a permanent shift.

The world will come together — even as it falls apart.

🔎Espresso Thoughts

It's clear the current Internet isn’t optimized for AI. We are rapidly moving to a new kind of Web. More open, more interoperable, more instantly monetized. The "original sin" of ad-based models will be replaced by micropayments with Stablecoins being the perfect currency for such a model. ZK will be the "glue" of this open internet where agents will be the able to roam freely and access data and “memories” that won’t have to be locked behind stupid paywalls and closed APIs. A good glimpse of the future is Auth demos like this. It's also very likely that the next version of the Web will be optimized for agents, not humans. API are already agentified. Websites will soon be as well. In that case, maybe a new device (not a laptop or a phone) will be better suited for humans who will move from online consumption -> AI companionship. Is this what Altman also thinks, hence the IO acquisition?

SEO fades towards irrelevance and to be honest this is music to my ears. People are increasingly spending more time with LLMs than search engines and SEO which spawned an entire industry of keyword stuffers, backlink brokers, content optimizers, and auditing tools isn’t relevant anymore. One potential new mode will be what a16z calls Generative Engine Optimization (GEO) which in a nutshell is optimizing how often LLMs choose to reference someone’s brand. How a model perceives a brand is more important than how consumers do. Another angle could be something along the lines of Agentic Interaction Optimization (AIO) which would favor brands whose websites have all the right tools to make agents interactions faster and easier (MCP, APIs, A2A etc).

I have been fascinated by the concept of “closed-loop payment networks” a term coined by Robbie Petersen. Everyone is familiar with these networks because we all have “loyalty points” in multiple retailers, airlines etc but when you conceptualize that these can now become stablecoin-first networks in crypto rails, you realize that the Payments industry will never be the same again. From a quick search for example, Starbucks has $1.7B loaded on its accounts/gift cards that the company can treat as a 0% interest loan, and with about 10% of funds eventually being forgotten, it’s actually a negative interest loan. And now imagine, each and every Starbucks point being a USDS (Starbucks stablecoin) that you can easily use for any other good you want to buy and that Starbucks can programmatically build automatic loyalty payments or any other campaign they run. Brands will eat the payment stack for breakfast.

Microsoft’s report about the “Frontier Firm” is spot on. Today’s structure of companies doesn’t make a lot of sense and will soon be obsolete. One thing that we need to rethink is the commercial/legal structure and come up with an equivalent model of Focused Research Organizations (FROs) but for 1-man organizations purely led by Agents. On the management side of things, Managers will quickly turn into Allocators. The right allocation of employees to jobs was always the main added value of Managers to firms. This will continue to be the case but with some small variations:

Employees -> Agents

Day to day interactions ->prompting

Team -> agent swarms

Weekly team calls -> agent swarm orchestration

Team culture -> long context & memory

OKRs -> verified JTBD framework

Regardless of the industry a company operates in, if they want to be successful in today’s environment, they need to ALSO be:

a tech company (that happened in 2010s with Cloud/Mobile)

an AI company (happening now)

a media company (intensified during COVID, for example Stripe recently released vidcasts)

an active geopolitical player (happening now with Open AI)

an embedded financial service provider (will be happening next year with native stablecoins/onchain loyalty)

Balaji thinks that “ZK arguably is to crypto, what the transformer is to AI.” I think it’s much bigger. ZK arguably is to the new Web, what the https is to Internet.

The next big innovation in AI will come from better, smarter and more efficient memory management solutions. Aaron Levie calls it the “Plaid for Memory”. In my mind, it’s another iteration of the same challenge already spotted at MCP and A2A. We need portability, interoperability, privacy if we want AI to really take off otherwise we will end up to today’s model of closed loops. ZK can solve this.

AI will win a Nobel sooner than a Pulitzer.

As more companies become AI-first, homogeneity is a risk. What will be the differentiating factor? For now, it's all about execution aka using AI efficiently. But in the future this will become norm. How can you infuse an LLM with your company's culture?

Which companies are actively using AI to design energy efficient AI chips? Shouldn't this be a bigger priority?

If I had to distill the 5-6 most important things that will shape the new world order in the next 10 years, these would be: rare earth minerals, energy, batteries, compute, intelligence, drones, internet capital markets.

Agent orchestrators will start being much more opinionated and this is good. For example, a Microsoft Healthcare Agent Orchestrator (this is a great demo from Shrey) tuned as Karl Popper (falsification oriented) may be better suited than a Spinoza one for drug discovery but not for patient management.

Sooner or later, someone will crack the "MCP appstore" thesis. The question is who and with what economics behind.

Who is training LLMs on satellite imaging? It seems to be the lowest hanging fruit for state capacity (military, industrial) and other industries like agriculture, insurance etc.

With tariffs impacting commerce, why hasn't 3D printing taken off yet?

📌 Mind Crunches

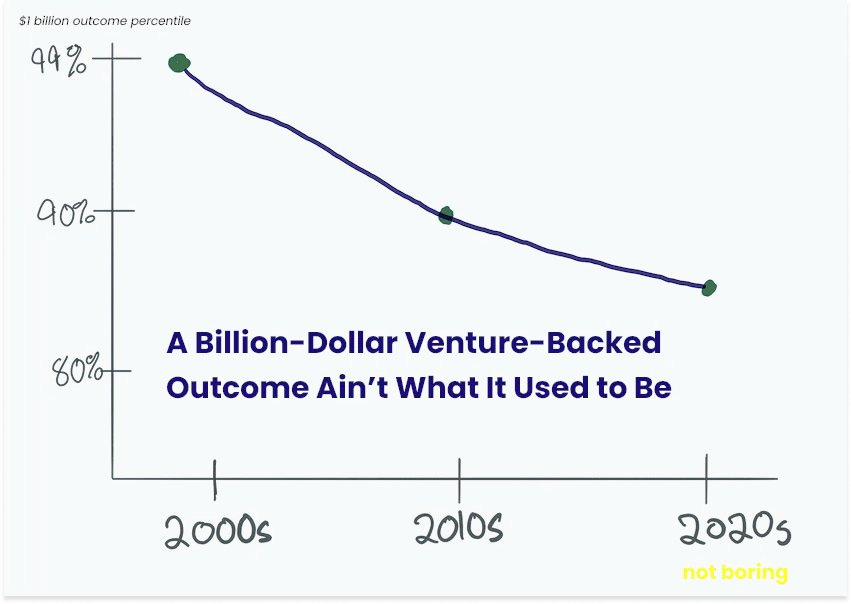

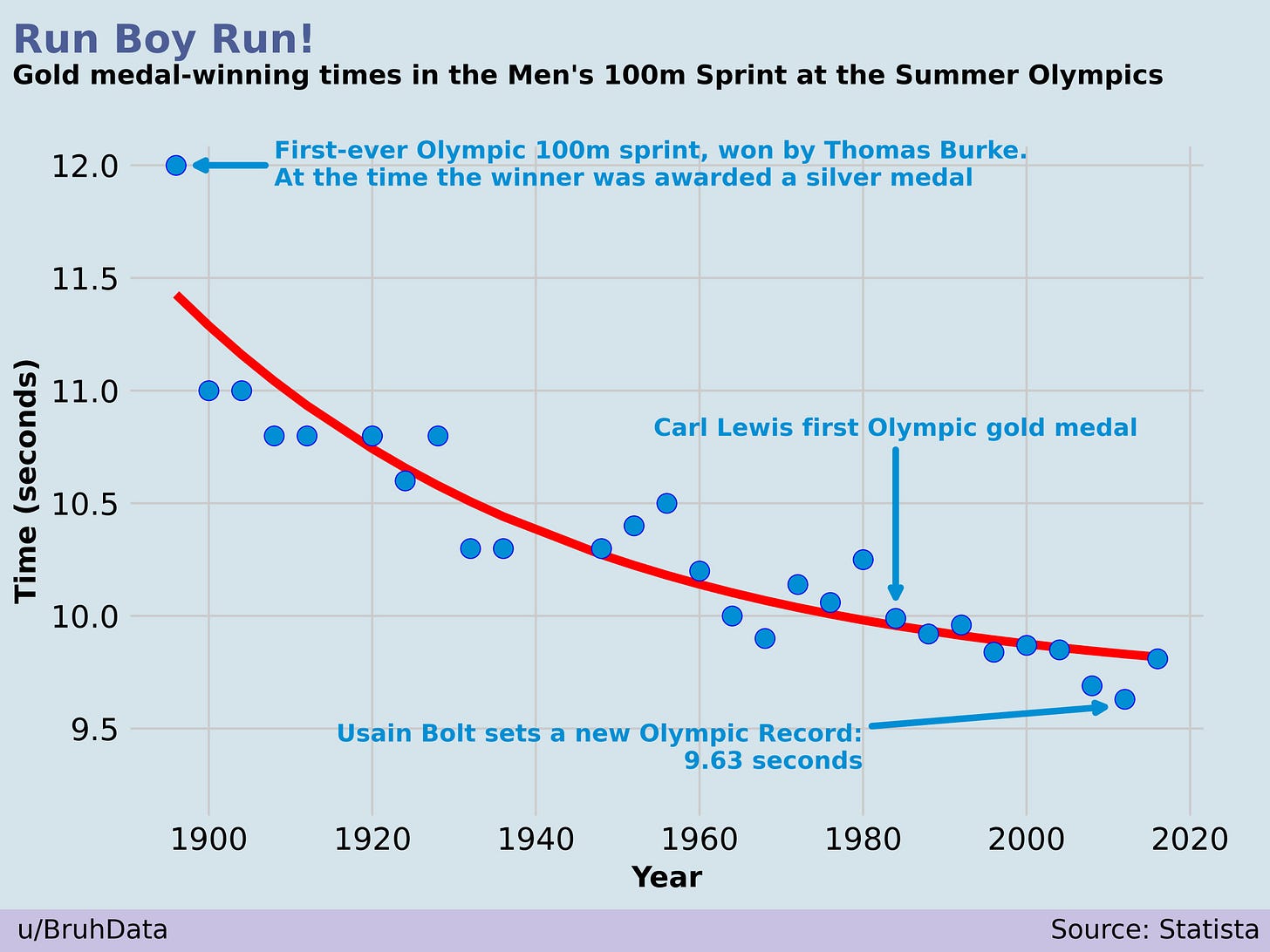

These two charts are coming from two completely different fields but they are showing the same thing. What Packy calls the “Everything is Technology” framework.

We have the first models of LegoGPT. This seems trivial or even a bit silly but it’s very big news. A more advanced LegoGPT combined with bigger + stronger robotic arms could completely change the economies of building housing (a next-gen @buildwithcuby) and improve state capacity (building roads, bridges).

As you have probably guessed, state capacity is something which I am increasingly getting obsessed with. The Industrial Policy Playbook from IFP is an excellent collection of essays and policy proposals that really deep dives on the actual challenges that hold American industrial capabilities back. Some of my favorite proposals: establishing special compute zones, reforming naval shipbuilding through commercial upskilling, innovation growth loan to SMBs.

The past 12 months, power group chats literally changed the world. Powerful and influential individuals found group chats to be a safe space from content moderated social platforms and used them to craft new memetic narratives that then spread in wider audiences. I see this as a logical evolution taking the good things from Clubhouse early success and shielding from the increasing anti-tech stance of journalists monitoring 24/7 for something, even remotely controversial, that a VC would write.

There is literally no reason for (the biggest part of) Consulting to exist as an industry. Let it burn to the ground!

ZK is eating the world.

The barbell theory of tomorrow’s workforce. We will need electricians and theologists. Nothing in the middle.

DAOs are coming for the fintechs. For example, Aave has more value locked in its platform than Revolut with 1/10 of Revolut’s workforce.

Latest Sam Altman blogpost on upcoming Singularity. Great read. I still see energy and policymaking to be major bottlenecks to reach AGI. Dwarkesh also thinks we are still far from AGI levels. If we do reach AGI, I am extremely concerned we dont have good Governance mechanisms in place.

There is no shortage of blogposts about Estonia’s digital transformation but this is definitely the most insightful. The most interesting part is that the small size of Estonia may be the single most deciding factor of this success. Remeber

Ukraine has developed a sophisticated points scheme “based on video games to boost the effectiveness of its soldiers” awarding specific point values for different types of kills. Prediction markets for the kill!

Recommended Blog: Hyperdimensional by Dean Ball.

Recommended Book: King Dollar: The Past and Future of the World's Dominant Currency

Recommended Podcast: “Innovation Begins With Gifts” Alex Danco on Dialectic

Quote: “Cognition goes all the way down to the molecular level” Michael Levin

(Photo from the excellent Thomas Gravanis)

I am always excited to join you in your mind-crunches by reading through all your references throughout the month. Exciting and thought provoking as always.

My physics mind thinks of glocalization like approaching a triple-point of a phase transition in some material. It is the point where liquid and gas begin to have no distinction. Local fluctuations scale and diverge to infinity. Local and global merge. And all this from as simple of a material as a drop of water.